FAQs - Choosing an Obamacare or Off-Exchange Health Insurance Plan

- Types of Costs

- Metal Levels

- Risk Decision

- HPR Affordability Rank

- Obamacare Subsidy

- Cost Sharing Reduction (CSR) plans

- Help With Subsidy and/or Enrolling

- What Else to Consider

Health Insurance Plans

Obamacare Plans

Off-Exchange Plans

Sign Up Help

Quote & Compare

Get advice from Licensed Insurance Agents

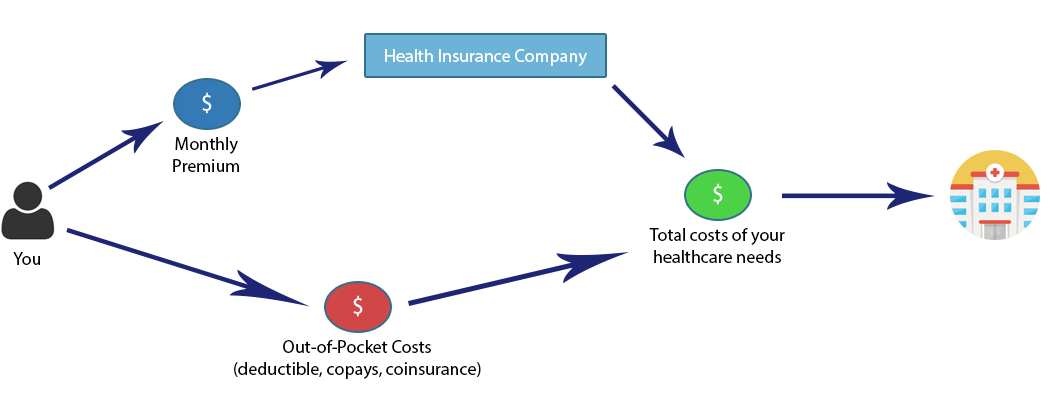

What are the two types of health insurance costs?

There are two types of costs associated with every health insurance plan:

- Monthly premium cost - the monthly cost of the plan

- Out-of-pocket costs - costs when you need medical care (deductible, copays, coinsurance)

The combination of these two costs equals the total costs of your healthcare needs.

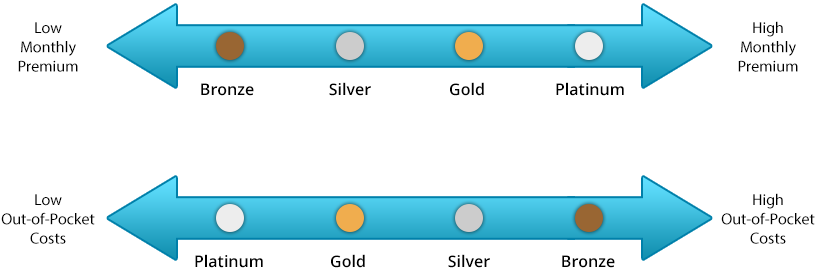

What do the “metal levels” of plans mean?

Metal levels define what portion of your total healthcare costs are from the monthly premium vs. out-of-pocket costs.

|

Monthly Premium percent of your healthcare costs |

Out-of-Pocket Costs percent of your healthcare costs |

Total costs of your healthcare needs |

|

|---|---|---|---|

| Bronze | 60% | 40% | 100% |

| Silver | 70% | 30% | 100% |

| Gold | 80% | 20% | 100% |

| Platinum | 90% | 10% | 100% |

For example, Bronze plans typically have low monthly premium costs but high out-of-pocket costs, while Platinum plans have high premium costs but low out-of-pocket costs.

How should I think about my “risk” decision when choosing a plan?

Now that you understand the two types of health insurance costs and the differences between metal levels, think about the “risk” decision you should make when choosing a plan:

Do you pay a lower premium now and risk having to pay a large portion of your medical costs when you need care?

OR

Do you pay a higher premium now and face less risk because you will pay a lower portion of your medical costs when you need care?

Everyone is going to have a different answer to their risk decision. Some very healthy people may want to buy a Bronze plan with a low premium and may want to take the risk that if they get injured or sick they will pay more for medical costs. Other people may not want to take a risk, and they will buy a Platinum plan with high premiums, and then pay less for medical costs if they need medical care. For others, a Silver or Gold plan with mid-level premiums and out-of-pocket costs is the best decision.

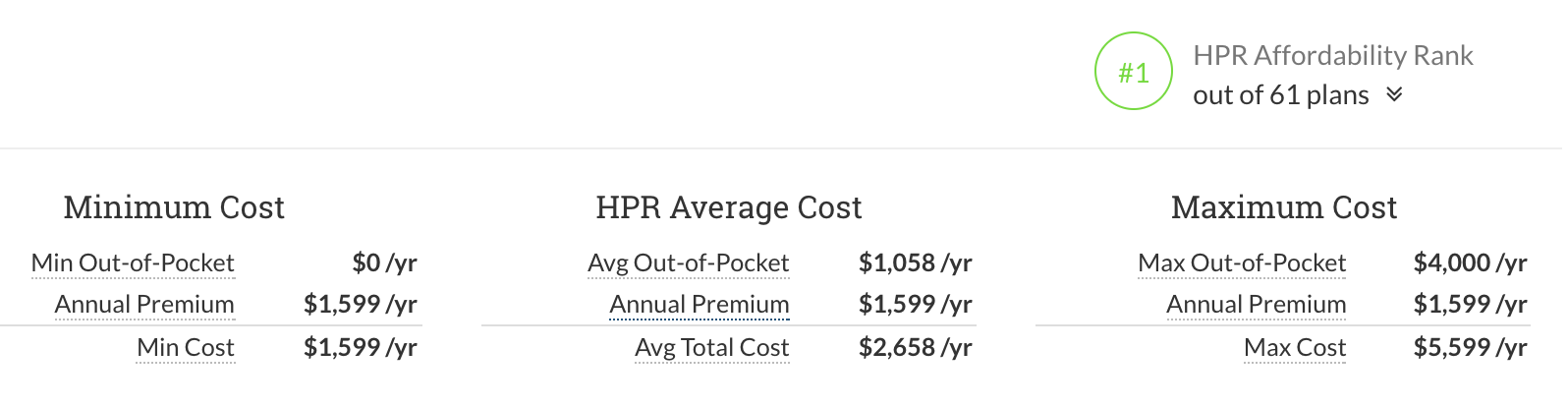

What is the affordability rank shown on Health Plan Radar?

Health Plan Radar has created our own formulas and ranking system to help you think about the affordability of each plan. Our affordability ranking is based on the combination of annual premium cost and total average out-of-pocket costs. We estimate out-of-pocket costs the average person will face for each plan. Remember this is an average. Some people will need a lot of medical care while others will need less medical care.

What is an Obamacare Subsidy?

The Obamacare Subsidy is a tax credit which you can use to reduce the monthly premium cost of plans. Your eligibility for a subsidy and the amount will depend on your annual household income. Health Plan Radar estimates whether you are eligible for a subsidy and the amount, but you will need to complete the federal government application process to learn your official amount. Health Plan Radar connects you to certified web brokers who can help you apply for a subsidy.

What are Cost Sharing Reduction (CSR) plans?

If you are eligible for a subsidy, you may also be eligible for Cost Sharing Reduction plans. CSR plans are Silver plans which have lower out-of-pocket costs (deductibles, copays, coinsurance) compared to normal Silver plans. CSR plans act as a second form of financial assistance. Pay attention to these plans which are likely your most affordable option.

What else should I consider when choosing a health insurance plan?

Does my doctor or hospital accept this health insurance plan?

If you would like to make sure your doctor or hospital accepts a certain plan, Health Plan Radar recommends checking the official provider directory of the health insurance company. We show a link to the official provider directory for each plan. Look for the Doctor Lookup link on Health Plan Radar.

Are my prescription drugs covered by this plan?

All plans are required to cover prescription drugs, but if you would like to make sure a plan covers your specific prescription needs, Health Plan Radar recommends checking the official preferred drug list of the health insurance company. We show a link to the official drug list for each plan. Look for the Drug List link on Health Plan Radar.