Health Insurance Definitions on Health Plan Radar

Health Insurance Plans

Obamacare Plans

Off-Exchange Plans

Sign Up Help

Quote & Compare

Get advice from Licensed Insurance Agents

Below are definitions and answers to common questions by different section of Health Plan Radar.

We also have definition pop-ups built into platform. When using Health Plan Radar hover over different terms and a question mark will show. Click for the definition pop-up.

Eligibility

Health Plan Radar may estimate your eligibility for different health insurance coverage options. Remember this is only an estimate. You will need to complete a federal government application to learn your official eligibility.

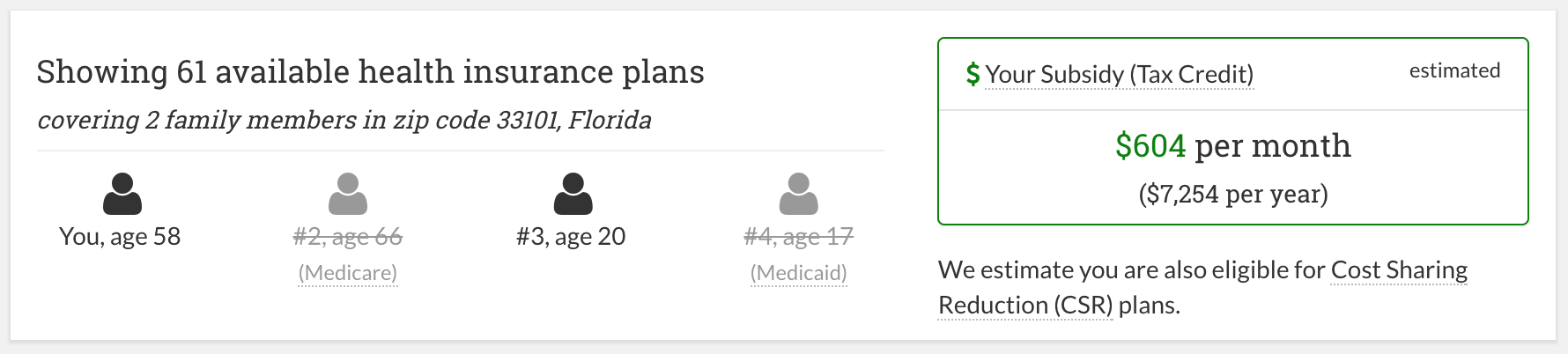

$ Your Subsidy (Tax Credit)

We estimate that you are eligible for a subsidy (tax credit) to reduce the cost of plans. Your subsidy amount shown below is an estimate. Web brokers or licensed insurance agents can help you complete a federal government application to learn your official subsidy amount.

Cost Sharing Reduction (CSR) Eligibility

CSR Plans are Silver plans with lower out-of-pocket costs (deductibles, copays, coinsurance) than normal Silver plans. Pay attention to these plans which may be more affordable.

Medicare

This family member is over 65 and may be eligible for health insurance through Medicare with premiums as low at $0. This family members is not included in the plans shown below because Medicare is usually more affordable.

Medicaid

Medicaid or CHIP is free or low cost health insurance from your State for people with certain income qualifications. This family member is not included in the plans shown because Medicaid is usually more affordable. We recommend visiting healthcare.gov to learn about your Medicaid or CHIP options.

Plans

Health Plan Radar shows you summary information of all your available plan options.

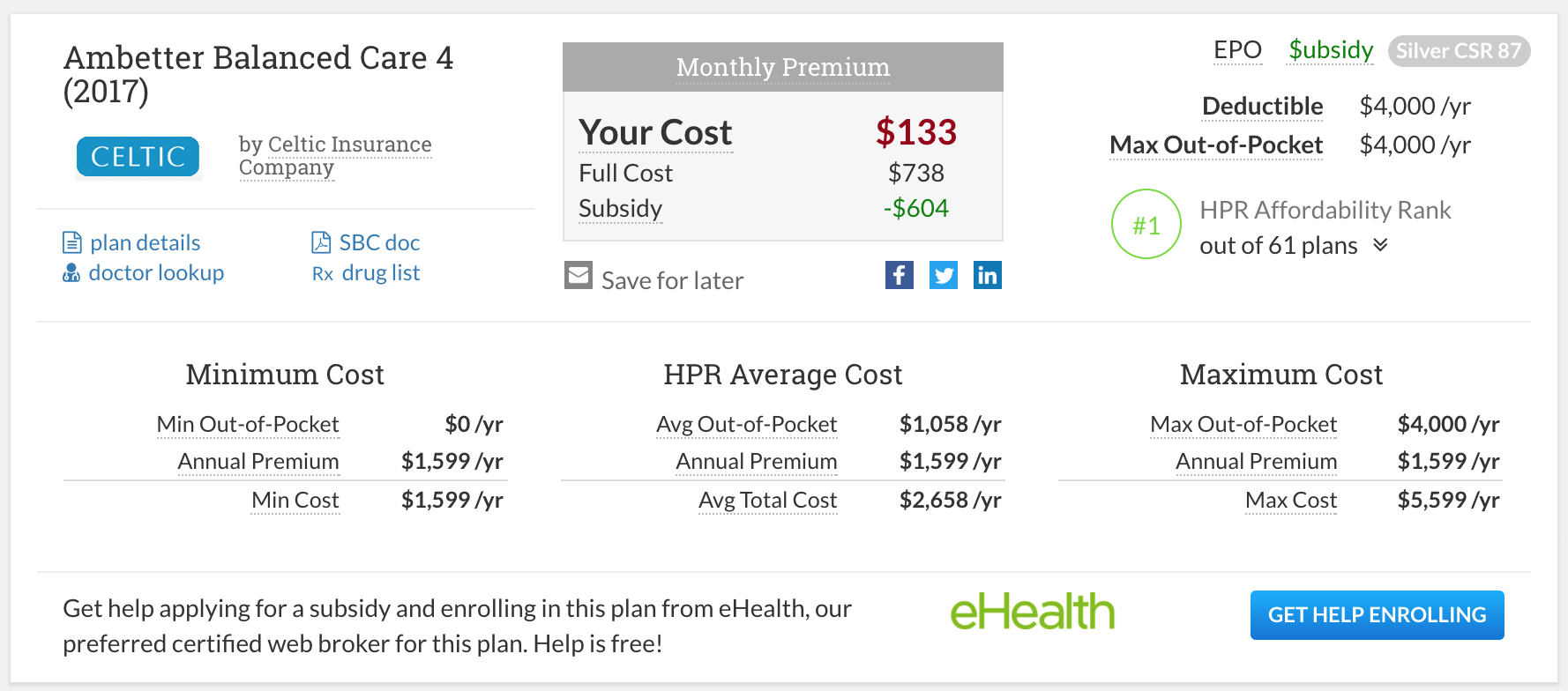

Plan Name

This is the name of the plan given by the health insurance company offering this plan.

Insurance Company

This is the insurance company offering this plan. Another name for insurance company is carrier or issuer.

Monthly Premium

Monthly premium is the monthly cost of this plan. The monthly premium does not include additional out-of-pocket costs you must pay when receiving medical care (deductibles, copays, coinsurance).

Your Cost

Your Cost is the monthly cost of this plan after using your subsidy (Full Cost - Subsidy).

Full Cost

You can use your Subsidy amount to reduce the monthly premium cost of this plan. Your Subsidy is a tax credit which you can use in advance each month instead of waiting until the end of the year.

Subsidy

You can use your Subsidy amount to reduce the monthly premium cost of this plan. Your Subsidy is a tax credit which you can use in advance each month instead of waiting until the end of the year.

HSA

This plan is eligible for a Health Savings Account (HSA), which can be used to pay for medical expenses with tax-free dollars. Plans must have a high deductible to be eligible for an HSA.

Catastrophic Plan

This plan is classified as a Catastrophic plan. Catastrophic plans usually have very low monthly premium costs, but very high out-of-pocket costs when you need medical care. Subsidies cannot be used for Catastrophic plans.

Bronze Plan

This plan is classified as a Bronze plan. Bronze plans usually have low monthly premium costs, but high out-of-pocket costs when you need medical care.

Silver Plan

This plan is classified as a Silver plan. Silver plans usually have low - medium monthly premium costs, but medium - high out-of-pocket costs when you need medical care.

Silver CSR Plans

This plan is classified as a Silver plan with Cost Sharing Reduction (CSR). Silver plans have low - medium monthly premium costs. Silver CSR plans have lower out-of-pocket costs when you need medical care, compared to regular silver plans.

Gold Plan

This plan is classified as a Gold plan. Gold plans usually have medium - high monthly premium costs, but low - medium out-of-pocket costs when you need medical care.

Platinum Plan

This plan is classified as a Platinum plan. Platinum plans usually have high monthly premium costs, but low out-of-pocket costs when you need medical care.

Deductible

You usually have to pay the full cost for medical care until you reach the deductible amount. After reaching the deductible amount you then starting paying for medical care based on the out-of-pocket cost details of the plan (copays, coinsurance). For plans covering a family, there are typically separate deductible amounts for individuals and the whole family. The deductible is reset each year and the monthly premium does not count towards the deductible.

Max Out-of-Pocket

Max Out-of-Pocket is the maximum amount you will have to pay for out-of-pocket medical costs (deductible, copays, coinsurance) when you need medical care. For plans covering a family, there are typically separate max out-of-pocket amounts for individuals and the whole family. Once you reach the max out-of-pocket amount you will not have to pay another dollar for medical care. The monthly premium does not count towards the max out-of-pocket.

HPR Affordability Rank

HPR Affordability Rank is Health Plan Radar's ranking of this plan's affordability compared to all your plan options. It is based on our estimate of the average total cost of each plan (premium + estimated average out of pocket costs).

Min Out-of-Pocket

The Min Out-of-Pocket is always equal to $0 per year. It represents the situation when you do not need any medical care and spent no out-of-pocket costs for deductibles, copays, coinsurance.

Annual Premium

Annual Premium is the yearly premium cost of this plan (monthly premium x 12).

Min Cost

Min Cost is the minimum total cost you could pay for this plan. It represents paying the plan's premium but not needing any medical care.

HPR Average Out-of-Pocket

HPR Average Out-of-Pocket is Health Plan Radar's estimate for the average out-of-pocket costs people covered by this plan will pay for medical care. Remember this is an average. Some people will need a lot of medical care while others will need less medical care.

Average Total Cost

Average Total Cost is Health Plan Radar's estimate for the average total cost member's of this plan will pay in a year. It is equal to the Annual Premium + HPR Average Out-of-Pocket.

Max Out-of-Pocket

Max Out-of-Pocket is the maximum amount you will have to pay for medical costs (deductibles, copays, coinsurance) when you need medical care. Once you reach your max out-of-pocket you will not have to pay another dollar for medical care. The max out-of-pocket is determined by the insurance company and is set for each plan.

Max Cost

Max Cost is the maximum total cost you could pay for this plan. It represents paying the plan's premium and requiring enough medical care to reach the max out-of-pocket amount (annual premium + max out-of-pocket)

EPO Plan

Exclusive Provider Organization (EPO) is a managed care plan where services are covered only if you use doctors, specialists, or hospitals in the plan’s network (except in an emergency).

HMO Plan

Health Maintenance Organization (HMO) is a type of plan that usually limits coverage to care from doctors who work for or contract with the HMO. It generally won't cover out-of-network care except in an emergency. An HMO may require you to live or work in its service area to be eligible for coverage. HMOs often provide integrated care and focus on prevention and wellness.

POS Plan

Point of Service (POS) is a type of plan where you pay less if you use doctors, hospitals, and other health care providers that belong to the plan’s network. POS plans require you to get a referral from your primary care doctor in order to see a specialist.

PPO Plan

Preferred Provider Organization (PPO) is a type of health plan where you pay less if you use providers in the plan’s network. You can use doctors, hospitals, and providers outside of the network without a referral for an additional cost.

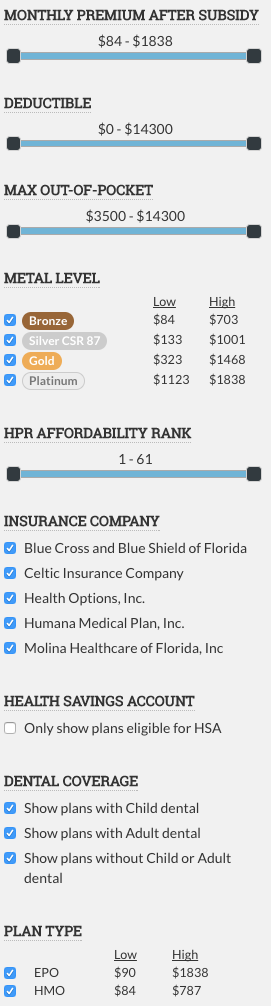

Plan Filters

Health Plan Radar has advanced filters and metrics, which allow you to easily compare plans and find the best and most affordable plan for you and your family.

Monthly Premium

Monthly premium is the monthly cost of plans.

Monthly Premium After Subsidy

Monthly premium after subsidy is the monthly cost of plans after using your subsidy (Full Cost - Subsidy)

Deductible

You usually have to pay the full cost for medical care until you reach the deductible amount. After reaching the deductible amount you then starting paying for medical care based on the out-of-pocket cost details of the plan (copays, coinsurance). For plans covering a family, there are separate deductible amounts for individuals and the whole family. The deductible is reset each year and the monthly premium does not count towards the deductible.

Max Out-of-Pocket

Max Out-of-Pocket is the maximum amount you will have to pay for out-of-pocket medical costs (deductible, copays, coinsurance) when you need medical care. Once you reach the max out-of-pocket amount you will not have to pay another dollar for medical care. The monthly premium does not count towards the max out-of-pocket.

Metal Level

Plans are classified into metal levels, which define the out-of-pocket cost level of plans (deductibles, copays, coinsurance) when you need medical care. Metal levels can also show typical premium amounts. For example, Bronze plans have high out-of-pocket costs but usually have low monthly premium costs.

Catastrophic

Catastrophic plans usually have very low monthly premium costs, but very high out-of-pocket costs when you need medical care. Subsidies cannot be used for Catastrophic plans.

Bronze

Bronze plans usually have low monthly premium costs, but high out-of-pocket costs when you need medical care.

Silver

Silver plans usually have low - medium monthly premium costs, but medium - high out-of-pocket costs when you need medical care.

Silver CSR

Silver plans have low - medium monthly premium costs. Silver CSR plans have lower out-of-pocket medical care costs compared to regular silver plans.

Gold

Gold plans usually have medium - high monthly premium costs, but low - medium out-of-pocket costs when you need medical care.

Platinum

Platinum plans usually have high monthly premium costs, but low out-of-pocket costs when you need medical care.

HPR Affordability Rank

HPR Affordability Rank is Health Plan Radar's ranking of a plan's affordability compared to all your plan options. It is based on our estimate of the average total cost of each plan (premium + estimated average out of pocket costs).

Insurance Company

These are the health insurance companies offering plans available to you. Insurance companies are sometimes called issuers or carriers.

Health Savings Account

Health Savings Account (HSA) is a type of savings account which can be used to pay for medical expenses with tax-free dollars. Not all plans are eligible for an HSA. Plans must have high deductibles and meet other requirements to be HSA eligible.

Dental Coverage

Some plans include dental coverage for certain adult or child dental expenses.

Plan Type

Plans are classified into different plan types, which define access to doctor and hospital networks and how the plan is administered.

EPO

Exclusive Provider Organization (EPO) is a managed care plan where services are covered only if you use doctors, specialists, or hospitals in the plan’s network (except in an emergency).

HMO

Health Maintenance Organization (HMO) is a type of plan that usually limits coverage to care from doctors who work for or contract with the HMO. It generally won't cover out-of-network care except in an emergency. An HMO may require you to live or work in its service area to be eligible for coverage. HMOs often provide integrated care and focus on prevention and wellness.

POS

Point of Service (POS) is a type of plan where you pay less if you use doctors, hospitals, and other health care providers that belong to the plan’s network. POS plans require you to get a referral from your primary care doctor in order to see a specialist.

PPO

Preferred Provider Organization (PPO) is a type of health plan where you pay less if you use providers in the plan’s network. You can use doctors, hospitals, and providers outside of the network without a referral for an additional cost.

Plan Details

Health Plan Radar shows more detailed plan information for each plan

Deductible (per individual)

You usually have to pay the full cost for medical care until you reach the deductible amount. After reaching the deductible you then starting paying for medical care based on the out-of-pocket cost details of the plan (copays, coinsurance). For plans covering a family, there are typically separate deductible amounts for individuals and the whole family. The deductible is reset each year and the monthly premium does not count towards the deductible.

Deductible (per family)

You usually have to pay the full cost for medical care until you reach the deductible amount. After reaching the deductible you then starting paying for medical care based on the out-of-pocket cost details of the plan (copays, coinsurance). For plans covering a family, there are typically separate deductible amounts for individuals and the whole family. The deductible is reset each year and the monthly premium does not count towards the deductible.

Max Out-of-Pocket (per individual)

Max Out-of-Pocket is the maximum amount you will have to pay for out-of-pocket medical costs (deductible, copays, coinsurance) for this plan. For plans covering a family, there are typically separate max out-of-pocket amounts for individuals and the whole family. Once you reach the max out-of-pocket amount you will not have to pay another dollar for medical care. The monthly premium does not count towards the max out-of-pocket.

Max Out-of-Pocket (per family)

Max Out-of-Pocket is the maximum amount you will have to pay for out-of-pocket medical costs (deductible, copays, coinsurance) for this plan. For plans covering a family, there are typically separate max out-of-pocket amounts for individuals and the whole family. Once you reach the max out-of-pocket amount you will not have to pay another dollar for medical care. The monthly premium does not count towards the max out-of-pocket.

Drug Deductible (per individual)

You usually have to pay the full cost for prescription drugs until you reach the drug deductible amount. After reaching the drug deductible amount you then starting paying for prescription drugs based on the out-of-pocket cost details of the plan (copays, coinsurance). For plans covering a family, there are typically separate drug deductible amounts for individuals and the whole family. The deductible is reset each year and the monthly premium does not count towards the deductible. The drug deductible amount can be included in the medical deductible and there may not be separate deductible amounts.

Drug Deductible (per family)

You usually have to pay the full cost for prescription drugs until you reach the drug deductible amount. After reaching the drug deductible amount you then starting paying for prescription drugs based on the out-of-pocket cost details of the plan (copays, coinsurance). For plans covering a family, there are typically separate drug deductible amounts for individuals and the whole family. The deductible is reset each year and the monthly premium does not count towards the deductible. The drug deductible amount can be included in the medical deductible and there may not be separate deductible amounts.

Drug Max Out-of-Pocket (per individual)

Drug Max Out-of-Pocket is the maximum amount you will have to pay for out-of-pocket for prescription drug costs (deductible, copays, coinsurance) for this plan. For plans covering a family, there are typically separate drug max out-of-pocket amounts for individuals and the whole family. Once you reach the max out-of-pocket amount you will not have to pay another dollar for prescription drugs. The monthly premium does not count towards the drug max out-of-pocket. The drug max out-of-pocket amount can be included within the medical max out-of-pocket and there may not be separate max out-of-pocket amounts.

Drug Max Out-of-Pocket (per family)

Drug Max Out-of-Pocket is the maximum amount you will have to pay for out-of-pocket for prescription drug costs (deductible, copays, coinsurance) for this plan. For plans covering a family, there are typically separate drug max out-of-pocket amounts for individuals and the whole family. Once you reach the max out-of-pocket amount you will not have to pay another dollar for prescription drugs. The monthly premium does not count towards the drug max out-of-pocket. The drug max out-of-pocket amount can be included within the medical max out-of-pocket and there may not be separate max out-of-pocket amounts.

Plan Type

Plans are classified into different plan types, which define access to doctor and hospital networks and how the plan is administered.

EPO

Exclusive Provider Organization (EPO) is a managed care plan where services are covered only if you use doctors, specialists, or hospitals in the plan’s network (except in an emergency).

HMO

Health Maintenance Organization (HMO) is a type of plan that usually limits coverage to care from doctors who work for or contract with the HMO. It generally won't cover out-of-network care except in an emergency. An HMO may require you to live or work in its service area to be eligible for coverage. HMOs often provide integrated care and focus on prevention and wellness.

POS

Point of Service (POS) is a type of plan where you pay less if you use doctors, hospitals, and other health care providers that belong to the plan’s network. POS plans require you to get a referral from your primary care doctor in order to see a specialist.

PPO

Preferred Provider Organization (PPO) is a type of health plan where you pay less if you use providers in the plan’s network. You can use doctors, hospitals, and providers outside of the network without a referral for an additional cost.

Includes Child Dental?

Some plans include dental coverage for certain adult or child dental expenses.

Includes Adult Dental?

Some plans include dental coverage for certain adult or child dental expenses.

Out-of-Pocket Costs

You usually have to pay the full cost for medical care until you reach the deductible amount. After reaching the deductible amount you then starting paying for medical care based on the out-of-pocket cost details of the plan (copays, coinsurance). Out-of-pocket costs are also called cost sharing.

Preventive Care

All health insurance plans are required to provide preventive care services at no cost. Examples of preventive care services are doctor checkups and certain lab tests.

Primary Care Visit

A primary care visit is a visit with a primary care physician, nurse, or other provider for services which are not considered preventive care.

Specialist Visit

A specialist visit is a visit with a physician who specializes in a specific area of medicine or group of patients to diagnose, manage, prevent or treat certain types of symptoms and conditions.

Emergency Room

Emergency room is a visit to the emergency room to receive an evaluation of an emergency medical condition and treatment.

Inpatient Facility

Inpatient facility is the facility cost for medical care you receive when admitted as an inpatient to a health care facility, like a hospital or skilled nursing facility.

Inpatient Physician

Inpatient physician is the provider cost for medical care you receive when admitted as an inpatient to a health care facility, like a hospital or skilled nursing facility.

Generic Drugs

Generic drugs are classified as Tier 1 drugs - your lowest cost option.

Preferred Brand Drugs

Preferred brand drugs are classified as Tier 2 drugs - your midrange-cost option.

Non-preferred Brand Drugs

Non-preferred brand drugs are classified as Tier 3 drugs - your highest-cost option.

Specialty Drugs

Specialty drugs are classified as Tier 4 drugs - additional high-cost options.